Decoding the Surge: How Bitcoin’s Market Dynamics Sparked a Price Spike

The Bitcoin ecosystem is renowned for its volatility and the complex interplay of market forces that drive its price movements. A recent analysis has shed light on a significant price spike, pointing towards the market’s ability to absorb mining output alongside other contributing factors. This development signals a robust demand for Bitcoin and highlights the intricate balance between supply, demand, and investor sentiment that governs its market value. In this article, we’ll unravel the mechanisms behind this recent price surge, examining the roles of mining output absorption, investor behavior, and broader market trends.

Understanding the Bitcoin Mining Ecosystem

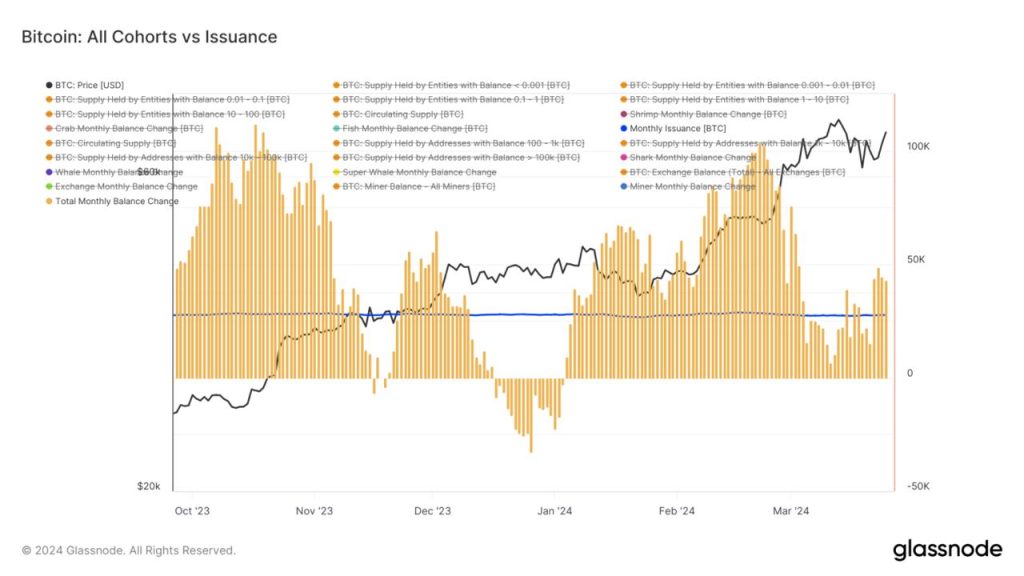

Bitcoin mining is a cornerstone of the cryptocurrency’s infrastructure, validating transactions and ensuring the network’s security through computational work. The output from mining activities represents a continuous influx of new Bitcoin into the market.

Impact of Mining Output on Market Dynamics

- Supply Meets Demand The ability of the market to absorb this constant supply of new Bitcoin without depreciating in value is a testament to its growing demand and maturity as a financial asset.

Catalysts of the Recent Price Spike

Several factors have converged to propel the recent uptick in Bitcoin’s price, from macroeconomic trends to shifts in investor sentiment. Understanding these elements offers insights into the cryptocurrency’s future trajectory.

Market Absorption and Investor Confidence

- A Sign of Strength The market’s capacity to soak up mining output indicates robust demand and confidence among investors, serving as a key driver behind the price increase.

The Role of Institutional Investors

The entrance of institutional investors into the Bitcoin space has been a significant factor in stabilizing and driving up prices. Their involvement suggests a level of trust and long-term commitment to cryptocurrency as an asset class.

Institutional Influence on Market Dynamics

- Driving Demand Institutional investments have not only provided a steady demand for Bitcoin but have also contributed to its legitimization and integration into the broader financial ecosystem.

External Economic Factors Influencing Bitcoin’s Price

The broader economic environment, including inflation rates, currency devaluation, and geopolitical tensions, plays a crucial role in shaping investor attitudes towards safe-haven assets like Bitcoin.

Bitcoin as a Hedge Against Inflation

- A Digital Gold Amidst economic uncertainties, Bitcoin’s appeal as a digital store of value akin to gold has become increasingly pronounced, contributing to its price resilience and growth.

Future Outlook: Navigating Bitcoin’s Volatility

While the recent price spike is a positive sign for Bitcoin enthusiasts, the cryptocurrency’s inherent volatility calls for cautious optimism. Investors must stay informed and agile, ready to navigate the unpredictable waters of the crypto market.

Strategies for Managing Volatility

- Diversification and Research Emphasizing the importance of portfolio diversification and ongoing market research as strategies to mitigate risks and capitalize on opportunities in the volatile crypto market.

The recent spike in Bitcoin’s price underscores the complex yet fascinating dynamics at play within its market. From mining output absorption to the growing confidence of institutional investors and the impact of macroeconomic factors, a multitude of elements contribute to the cryptocurrency’s valuation. As the market continues to mature, understanding these underlying mechanisms will be crucial for investors looking to navigate the crypto space effectively.

FAQs

- How does Bitcoin mining output affect its price? Mining output introduces new Bitcoin into the market, and the market’s ability to absorb this supply without depreciating in value indicates strong demand.

- What role do institutional investors play in Bitcoin’s market dynamics? Institutional investors stabilize and drive up Bitcoin’s price through substantial and strategic investments, signaling confidence in its long-term value.

- Why is Bitcoin considered a hedge against inflation? Bitcoin is seen as a digital gold, offering a decentralized and finite alternative to traditional fiat currencies, making it attractive during times of economic instability.

- How can investors manage the volatility of Bitcoin? Strategies include diversifying investment portfolios and staying abreast of market trends and fundamental analyses to make informed decisions.

- What are the future prospects for Bitcoin’s price? While Bitcoin’s price is subject to volatility, its growing acceptance, demand, and role as a hedge against inflation suggest a positive outlook, albeit with fluctuations.