Bitcoin’s High-Stakes Gamble: The $40 Billion Leveraged Bet

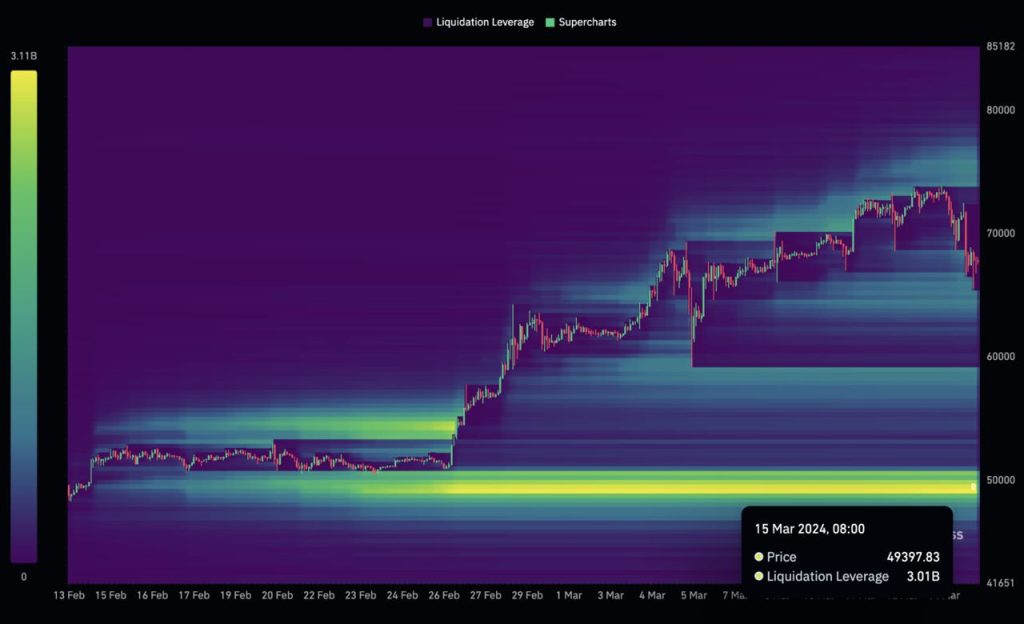

In the dynamic world of Bitcoin trading, a noteworthy trend has emerged that captures the essence of optimism and risk-taking within the cryptocurrency market. Long traders, those betting on the future rise of Bitcoin’s price, are currently leveraging positions with a staggering notional value exceeding $40 billion, with Bitcoin prices towering above $50,000. This phenomenon highlights not only the confidence of these traders in Bitcoin’s upward trajectory but also underscores the significant risks associated with high leverage in the volatile cryptocurrency market.

Understanding the Leverage Landscape

Leverage in cryptocurrency trading allows investors to amplify their exposure to price movements by borrowing funds. While this can lead to amplified gains, it also significantly increases the risk of losses, especially in a market as unpredictable as Bitcoin’s.

The Mechanics of Leverage in Bitcoin Trading

- Exploring how leverage works in the context of cryptocurrency trading

- The role of leverage in enhancing returns and amplifying risks

Current Trends in Leverage Among Bitcoin Traders

- A closer look at the $40 billion in leveraged long positions

- Factors driving the surge in leveraged trading activity

The Optimism Behind the $40 Billion Bet

This massive collective wager on Bitcoin’s future price rise reflects a deep-seated optimism among traders about the cryptocurrency’s potential. However, this enthusiasm is not without its challenges.

Drivers of Optimism

- Key factors fueling confidence in Bitcoin’s price growth

- The impact of global economic indicators and cryptocurrency adoption trends

Risks and Rewards

- The potential rewards of successful leveraged trades

- The risks of liquidation and financial loss in the event of price declines

Market Implications of High Leverage Trading

The prevalence of highly leveraged positions has significant implications for the Bitcoin market, affecting liquidity, volatility, and the potential for sharp price corrections.

Influence on Bitcoin’s Price Volatility

- How leveraged positions can exacerbate price swings

- The potential for cascading liquidations and their impact on market stability

Strategies for Managing Risk

- Risk management strategies for traders engaging in leveraged trading

- The importance of responsible leverage and position sizing

Looking Ahead: The Future of Leveraged Bitcoin Trading

As Bitcoin continues to evolve and attract attention from both retail and institutional investors, the dynamics of leveraged trading are likely to remain a central theme in discussions about market health and investor behavior.

Regulatory Considerations

- The potential for increased regulatory scrutiny of leveraged trading practices

- How regulations might shape the future landscape of Bitcoin trading

Adapting to Market Changes

- Strategies for traders to adapt to changing market conditions

- The role of technological advancements in managing leveraged trading risks

Conclusion: Navigating the High Seas of Bitcoin Leverage

The $40 billion in leveraged long positions on Bitcoin above $50,000 price levels represents a bold statement about the confidence many traders have in the cryptocurrency’s future. However, this high-stakes gamble also highlights the need for cautious optimism, responsible risk management, and an awareness of the market’s inherent volatility. As the Bitcoin market continues to mature, the community’s approach to leverage will be a critical factor in shaping its resilience and long-term stability.