The Critical Timing of Bitcoin Investments: Navigating the Top 10 Days for Optimal Gains

Understanding the Volatility of Bitcoin

The Highs and Lows

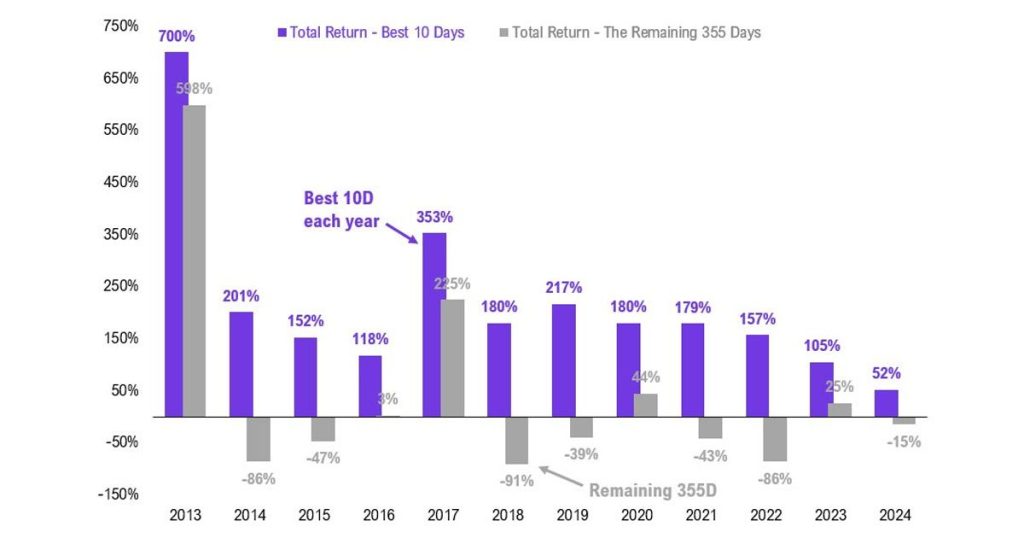

Bitcoin’s market is renowned for its sharp fluctuations, with significant price movements often occurring within short time frames. This volatility, while daunting for some, presents unique opportunities for substantial gains, particularly for those who are present during its most lucrative days.

The Impact of Missing Out

Fundstrat’s analysis reveals a compelling narrative: being absent from the market on Bitcoin’s top 10 performing days each year could dramatically alter an investor’s return profile, potentially turning positive annual gains into break-even scenarios or even losses. This phenomenon underscores the disproportionate impact of these peak days on annual investment performance.

Strategies for Capturing Bitcoin’s Best Days

Active vs. Passive Investment Approaches

Investors must weigh the benefits of active engagement with the market against the merits of a more passive, long-term investment strategy. While the former requires keen market observation and timing, the latter advocates for a ‘hold’ strategy, minimizing the risk of missing out on Bitcoin’s most profitable days.

Diversification and Risk Management

Diversification across different cryptocurrencies and investment vehicles can mitigate the risk of adverse outcomes on days of significant volatility. Additionally, employing risk management techniques, such as setting stop-loss orders, can protect investments from extreme market downturns.

Leveraging Technology and Analytics

Advanced analytics and trading algorithms can help investors identify potential trends and market movements, increasing the chances of being present during critical trading days. The use of such technologies, however, requires a deep understanding of market indicators and the factors driving Bitcoin’s price movements.

The Broader Implications for Cryptocurrency Investment

Educating the Investor Community

The insight provided by Fundstrat highlights the need for investor education on the nuances of cryptocurrency markets. Understanding the importance of market timing, along with the tools and strategies available to navigate these waters, is crucial for maximizing investment returns.

Rethinking Investment Strategies

This analysis prompts a reevaluation of traditional investment strategies in the context of digital currencies. Investors might consider how conventional wisdom on market participation and timing applies to the highly volatile and unpredictable nature of cryptocurrencies like Bitcoin.

Conclusion

The revelation that missing Bitcoin’s top 10 trading days each year could significantly impact annual gains offers a critical lesson for investors: in the realm of cryptocurrency, timing is not just a factor—it’s the factor. As the market for digital currencies continues to evolve, so too must the strategies employed by those looking to profit from its fluctuations. By staying informed, diversifying investments, and leveraging technology, investors can better position themselves to capture the full potential of Bitcoin’s most lucrative days.

FAQs

- Why are Bitcoin’s top 10 trading days so important? These days often account for the majority of annual gains, highlighting the impact of short-term market movements on long-term investment outcomes.

- Can investors predict Bitcoin’s top trading days? While predicting the exact timing of these days is challenging, investors can employ market analysis and technological tools to improve their chances of participation during significant price movements.

- What risks are associated with trying to time the market? Attempting to time the market carries the risk of missing out on crucial trading days, which could drastically affect annual returns. It also increases exposure to market volatility and emotional trading decisions.

- Is a passive investment strategy better for cryptocurrency? Whether a passive or active investment strategy is better depends on an individual’s risk tolerance, investment goals, and capacity to monitor the market. Each approach has its advantages and potential drawbacks in the context of cryptocurrency investing.

- How can investors mitigate the risk of missing out on significant gains? Diversification, employing stop-loss orders, and using a blend of active and passive investment strategies can help investors mitigate risks and increase the likelihood of capturing significant market gains.