Exploring the Minimal Outflow of $44 Million from GBTC Since the Spot ETF Conversion

Understanding the Significance

The Grayscale Bitcoin Trust: A Primer

Before we dive into the recent developments, it’s crucial to understand what GBTC is. The Grayscale Bitcoin Trust has been a pivotal structure, allowing investors to gain exposure to Bitcoin’s price movements without the complexities of direct cryptocurrency ownership. This has been particularly appealing for those looking to invest through traditional investment vehicles.

The Transition to a Spot ETF

The conversion of GBTC into a spot ETF marks a transformative phase in cryptocurrency investment vehicles. This move was anticipated to bridge the gap further between traditional financial markets and the burgeoning world of digital currencies, offering a more regulated and accessible means for institutional and retail investors to enter the crypto space.

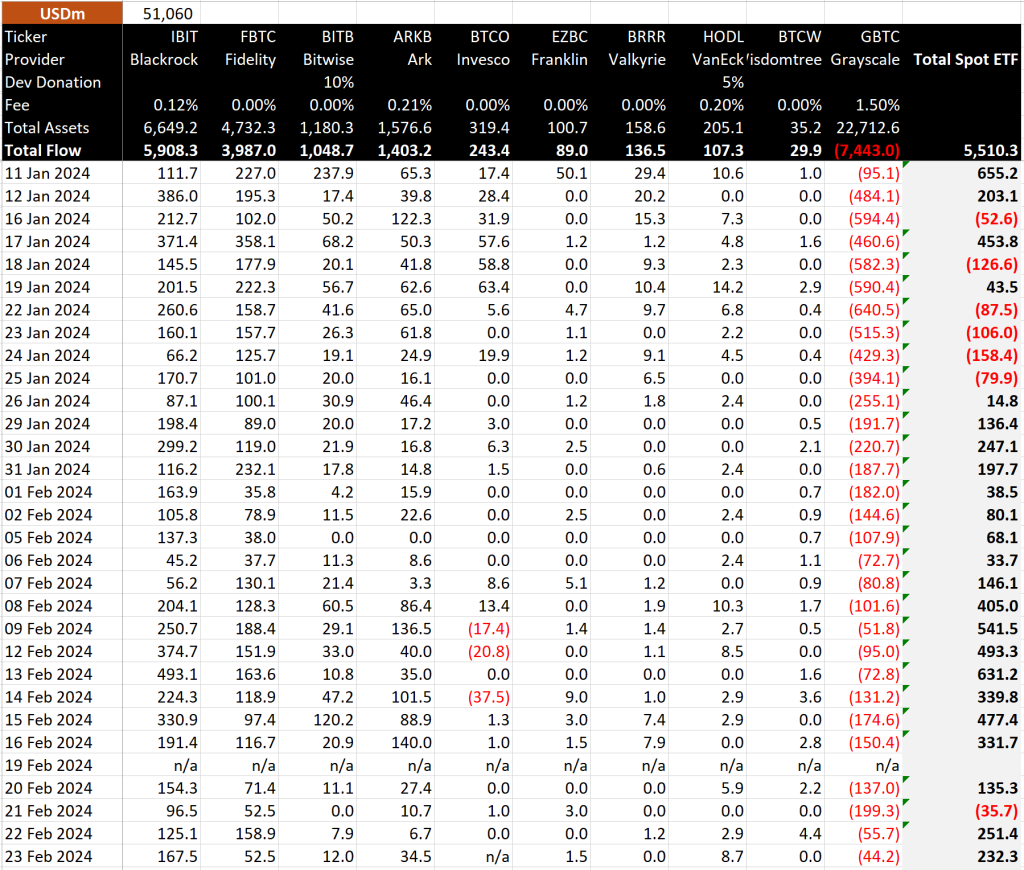

Analyzing the $44 Million Outflow

Context and Comparison

The $44 million outflow, while seemingly modest in the grand scheme of global finance, is a noteworthy indicator of investor sentiment and market stability. In the volatile realm of cryptocurrencies, where double-digit percentage swings are not uncommon, this minimal outflow signals a period of relative calm and confidence among investors.

Implications for Investors

For investors, this trend could be interpreted as a sign of maturation in the crypto market. It suggests that the mechanisms for investing in digital assets, like the GBTC, are becoming more robust, potentially leading to a decrease in speculative trading and an increase in long-term investment strategies.

The Market’s Response

Investor Sentiment and Market Dynamics

The market’s response to the GBTC’s minimal outflow has been cautiously optimistic. Analysts and investors alike are keenly observing how this development might influence the broader acceptance and integration of digital assets within traditional investment portfolios.

Future Prospects for GBTC and the Crypto Market

This development could pave the way for more traditional financial products and services that cater to the growing demand for cryptocurrency investments, ultimately contributing to the mainstream acceptance of digital assets.

Strategic Considerations for Crypto Investors

With the landscape of digital asset investment evolving, investors are advised to stay informed about the latest trends and regulatory changes. Diversification, due diligence, and a clear understanding of risk management principles are more crucial than ever in navigating the crypto market.

Conclusion: A Milestone in Cryptocurrency Investment

The minimal outflow of $44 million from GBTC since its spot ETF conversion is more than a mere statistic. It symbolizes the growing integration of cryptocurrencies into the conventional financial ecosystem and highlights the increasing sophistication of digital asset management strategies. As the crypto market continues to mature, such developments are invaluable in building investor confidence and fostering a more stable and diversified investment landscape.

Frequently Asked Questions (FAQs)

- What does the minimal outflow from GBTC indicate about investor sentiment?

- It suggests a period of stability and growing confidence among investors in the cryptocurrency market.

- How does the conversion of GBTC to a spot ETF affect the average investor?

- It provides more regulated and potentially safer investment options for those looking to invest in Bitcoin and other cryptocurrencies.

- What should investors consider when looking into digital asset investments like GBTC?

- Investors should focus on diversification, understanding the underlying assets, and keeping abreast of regulatory changes.

- Can we expect more traditional financial products centered around cryptocurrencies in the future?

- Yes, the success of products like GBTC paves the way for more traditional financial instruments tailored to digital assets.

- How does the GBTC’s performance influence the broader crypto market?

- GBTC’s performance and investor sentiment can serve as indicators of the market’s maturity and stability, influencing broader market dynamics.