The End-of-Year Decline in Hash Rate: Debating Over Miner Sell-Offs

A Shift in the Crypto Mining Landscape

As the year draws to a close, the cryptocurrency mining sector faces a notable shift. A significant decline in hash rate has sparked widespread debate and concern. This article delves into the reasons behind this trend, its implications for the crypto community, and the broader debate over miner sell-offs.

Understanding Hash Rate Dynamics

The Essence of Hash Rate in Cryptocurrency

Defining Hash Rate

Before delving into the decline, it’s crucial to understand what hash rate means. Simply put, it’s the measure of the computational power per second used when mining. A higher hash rate implies more competition among miners to validate new blocks, and by extension, a more secure blockchain.

Factors Influencing Hash Rate

Economic and Technical Aspects

Various factors, including market prices, energy costs, and technological advancements, significantly influence the hash rate. A fluctuation in any of these can lead to changes in the mining landscape.

The Recent Decline in Hash Rate

Observing the Trend

Data and Analysis

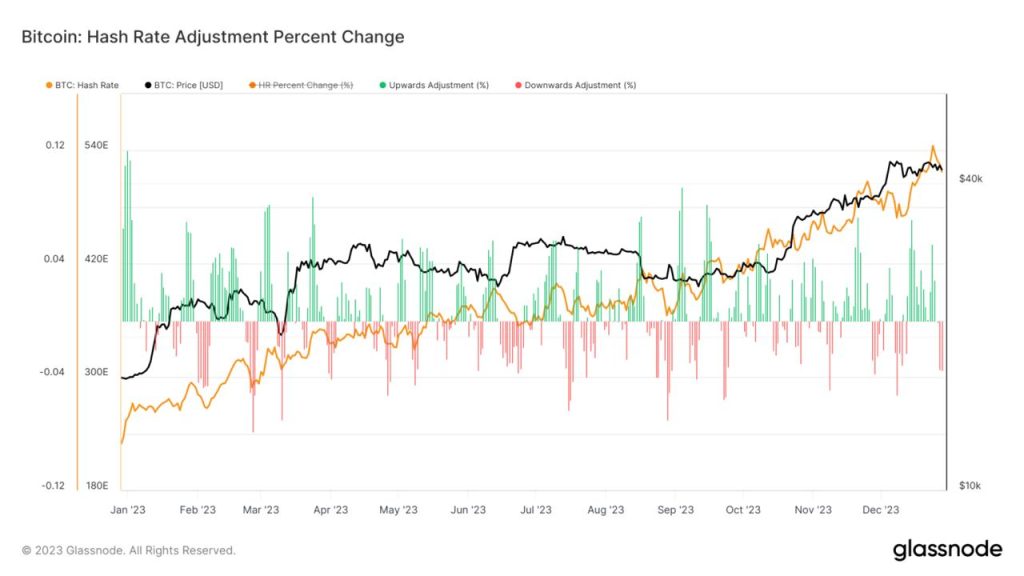

Recent data has shown a noticeable drop in hash rate towards the year’s end. This trend raises questions about its causes and the potential motivations of miners.

Possible Reasons for the Decline

Economic Pressures and Market Dynamics

The decline could be attributed to various factors, including the lowering of cryptocurrency prices, increased energy costs, or miners reaching a break-even point where mining becomes less profitable.

The Debate Over Miner Sell-Offs

Understanding Miner Sell-Offs

The Concept and Impact

Miner sell-offs refer to the situation where miners start selling their cryptocurrency holdings, typically due to economic pressures or strategic decisions. This can lead to an increased supply of cryptocurrencies in the market, potentially affecting prices.

Perspectives in the Debate

Different Angles and Opinions

The crypto community is divided over this trend. Some view it as a natural market correction, while others see it as a sign of underlying issues within the mining sector.

Implications for the Crypto Market

Short and Long-Term Effects

Market Stability and Investor Sentiment

The decline in hash rate and potential miner sell-offs could affect market stability and investor confidence, both in the short and long term. Understanding these dynamics is crucial for anyone involved in the cryptocurrency space.

Navigating a Changing Landscape

The end-of-year decline in hash rate and the debate over miner sell-offs highlight the complexities of the cryptocurrency mining sector. As the industry continues to evolve, staying informed and adaptable is key to navigating these changes.

FAQs

- What does a decline in hash rate indicate?

- A decline in hash rate can indicate less competition among miners and possibly less security for the blockchain. It often reflects changes in economic or technical factors.

- Why might miners sell off their crypto holdings?

- Miners might sell off holdings due to economic pressures, like lower crypto prices or higher energy costs, making mining less profitable.

- How does a miner sell-off affect the cryptocurrency market?

- Miner sell-offs can increase the supply of cryptocurrencies in the market, potentially leading to price changes and affecting investor sentiment.

- Is the hash rate decline a cause for concern?

- It depends on the context; it can be a cause for concern if it reflects underlying issues in the mining sector, but it can also be a part of natural market dynamics.

- What should crypto investors and enthusiasts do in light of these trends?

- Staying informed about market trends and understanding the implications of changes in the mining sector is crucial for making informed decisions.