Bitcoin’s Unprecedented Surge: Analyzing the $24 Million Transaction Fee Phenomenon

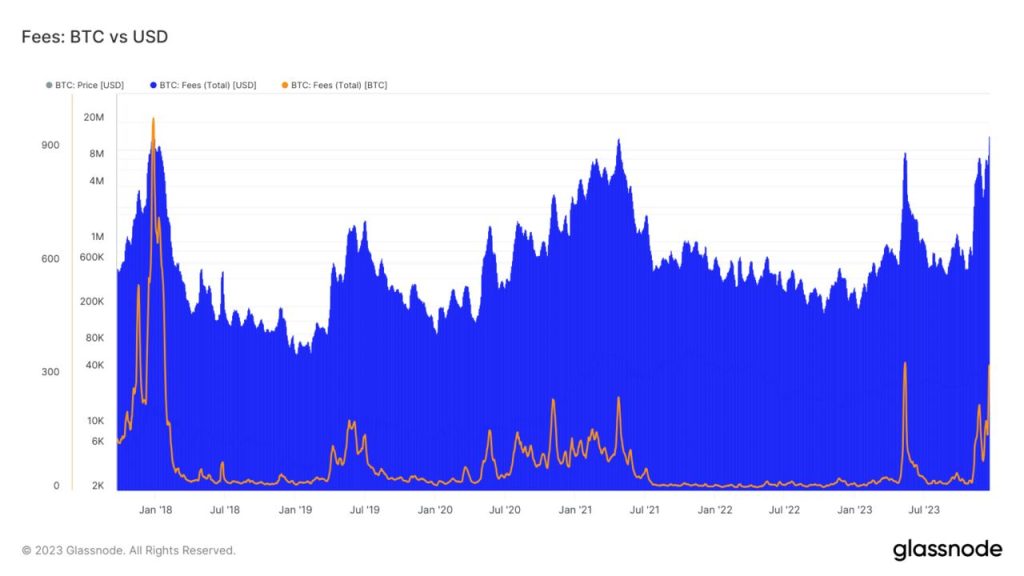

In the ever-evolving world of cryptocurrencies, Bitcoin has recently hit a milestone that’s causing ripples across the financial landscape. Let’s explore this remarkable day where Bitcoin’s transaction fees surged to an astonishing $24 million, setting a new record in its history.

Understanding Bitcoin’s Transaction Fees

H2: The Mechanics Behind the Fees Before we jump into the specifics of this record-breaking event, it’s crucial to understand how Bitcoin transaction fees work. These fees are paid to miners for processing and securing transactions on the blockchain. The fee amount can fluctuate based on network demand and the data size of the transaction.

Why Do Fees Fluctuate?

H3: Factors Influencing Bitcoin Fees Several factors impact Bitcoin transaction fees, including network congestion, data size of transactions, and miner demand. When the network is busy, users are willing to pay more to prioritize their transactions, leading to higher fees.

The Record-Breaking Day

H2: A Deep Dive into the $24 Million Phenomenon On this unprecedented day, Bitcoin’s transaction fees surged to a staggering $24 million. This surge is a reflection of several key factors at play within the cryptocurrency market.

Analyzing the Cause

H3: What Triggered the Surge? The primary driver behind this surge was an increased demand for transaction processing on the Bitcoin network. This demand could be attributed to a variety of factors, including market volatility, increased trading activity, or large-scale movements of Bitcoin by major players.

Comparing with Historical Data

H3: How Does This Stand in Bitcoin’s History? To put this in perspective, this fee surge is significantly higher than the average daily transaction fees seen in Bitcoin’s history. It highlights the growing usage and the dynamic nature of the network.

Implications of the Surge

H2: The Broader Impact on the Crypto World This record-breaking surge in transaction fees has several implications for Bitcoin users and the cryptocurrency market as a whole.

Impact on Users

H3: How It Affects Bitcoin Transactions For regular users, higher transaction fees might mean reconsidering transaction timings or amounts. It also underscores the importance of understanding fee dynamics when engaging in Bitcoin transactions.

Market Responses

H3: Investor and Market Reactions From an investor’s standpoint, such fluctuations can signal market movements, influencing trading strategies. It also brings attention to the scalability challenges faced by the Bitcoin network.

Looking Forward

H2: Future of Bitcoin’s Transaction Fees This event raises questions about the future of Bitcoin’s fees and scalability. Will such surges become more common? How will the network adapt?

Scalability Solutions

H3: Addressing the Challenges There are ongoing discussions and developments aimed at addressing Bitcoin’s scalability, such as the Lightning Network and other protocol upgrades. These solutions aim to reduce congestion and fees, making Bitcoin more efficient.

What This Means for Bitcoin’s Future

H3: Long-Term Implications This record-breaking day could be a catalyst for further innovation in the cryptocurrency space, driving solutions that balance efficiency with security.

The $24 million fee surge is more than just a headline – it’s a critical moment in Bitcoin’s journey, highlighting its growing pains and the relentless drive towards innovation in the cryptocurrency world.

FAQs

- What caused Bitcoin’s transaction fees to surge to $24 million? The surge was primarily due to increased network demand and transaction processing activity on the Bitcoin blockchain.

- How do transaction fees impact regular Bitcoin users? Higher fees might influence users to adjust their transaction timings or amounts and highlight the need to understand fee dynamics.

- What are the long-term implications of such surges in fees? These surges could accelerate efforts towards scalable solutions, influencing the future efficiency and usability of Bitcoin.

- Are there any solutions to Bitcoin’s scalability and fee challenges? Yes, solutions like the Lightning Network are being developed to address scalability issues and reduce transaction fees.

- Does this fee surge indicate a problem with the Bitcoin network? While it highlights scalability challenges, it also reflects the growing usage and dynamic nature of the network.